Benefits of Dual Occupancy Homes

While traditional investment options—stocks yield about 7% return per annum, and a typical residential property return is about 4% rental yield, investing in a ‘Dual Occupancy Home’ can get you a whopping 19-20% rental return.

As the market for rental property and affordable housing in Australia is booming, dual-occupancy homes are a great way to capitalize on the trend. In fact, dual occupancy has an in-built market, including students, young couples, small families, and retirees. On top of that, the return on a dual occupancy property is so high that it’s incomparable to traditional investments.

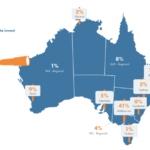

That’s the reason dual property investments are gaining traction among investors across the country, particularly in top cities like Brisbane, Perth, and now Melbourne.

So, whether you want to create a living space for an extended family, are looking for an investment property, or want to maximise your existing block of land, a dual-occupancy is an option worth exploring.

Let’s get started:

What Is a Dual Occupancy Home?

A dual occupancy home consists of two separate dwellings built on a single block of land. Put simply, it’s two homes on the same land—each having its own separate entrance and living space. But it’s worth noting that both dwellings are on the single title; so, no subdivision is required.

Dual occupancy homes are also popular as a dual key home, an auxiliary unit, or a granny flat. Although they may look like duplexes, they differ because duplexes have separate titles, allowing them to be sold separately. Dual occupancy investment properties, on the other hand, are treated as a single property. This means two separate rental incomes from one property.

Benefits of Investing in A Dual Occupancy: Real Numbers

Let’s look at Perth as an example:

Standard 4-Bedroom Investment

- Land size: 375m²

- House and land price: $780,000

- Rental yield: 5%

- Weekly rent: $750

Dual Key Investment

- Land size: 375m²

- House and land price: $870,000

- Weekly rent: $1,100

- Rental yield: 6.6%

For just around $90,000, you can add an auxiliary unit and increase your weekly rent by $350. That additional rental income equates to a 19% return on the extra investment — and in some suburbs, it rises above 20%. What other asset class can give you that massive return on investment?

Benefits of a Dual Occupancy Investment Property

Positive cash flow from day one: The extra income from the second unit means positive cash flow from the start. Even if one unit is vacant, the other continues to generate rent — a benefit a standard investment property cannot offer.

Stronger borrowing power: Increased income means higher chances to qualify for larger loans to finance more investments. This means more income and a more expanded portfolio faster. Plus, you can use the surplus rent to pay down mortgages faster.

Strong capital growth: A growingly strong demand for dual living can significantly boost your property’s overall value. This capital growth can yield substantial profits, particularly via a premium on resale. It also increases the owner’s equity, which can be used for further property investments.

Larger tax benefits: More bathrooms, more kitchens, and more fixtures mean larger depreciation claims, which translate into thousands of dollars in annual tax savings. Combining these substantial tax savings with higher rental income means an impressive overall return on investment.

For homeowners, dual occupancy homes provide the opportunity to stay close to their adult children, elderly parents, or extended family while maintaining independence for occupants.

Video of the walkthrough of the Dual income home!

➡️➡️ CLICK HERE

Decided on a Dual Occupancy Home? Call Property Buyers Australia Group Today!

Property investment should be a decision that helps you progress toward your financial goals—An option to maximise income, reduce risk, and boost capital growth. Dual occupancy homes tick all those boxes.

It can transform your single block of land into a powerful wealth-building asset with higher cash flow, better tax benefits, and greater equity growth—benefits that typical investments don’t match.

Discover how this strategy can benefit you — or enquire about dual occupancy investment in Melbourne, by calling 0432 555 415 now. And be sure to do your own due diligence before making any investments.