2026 will bring great opportunities for property sellers and investors in Australia.

The Australian housing market rose by 1.0% in November 2025 and continues to grow. The new government rules for first-time home buyers, higher interest rates, and their stability amid population growth are among the reasons for high prices.

With property demand remaining high and supply still tight, sellers can benefit in the coming months. According to experts, this is not just a boom, but a period of prolonged property price growth.

House Prices in Australia Continue to Rise

According to the latest data, home values in Australia recorded their third consecutive month of price increases through November 2025. The national median dwelling price now stands at A$888,941, while combined capital-city prices are A$978,077.

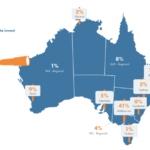

In the past 12 months, the national home prices grew by 8.7%. And, prices in capital cities have increased by 8.5% during the same period.

In addition, the house rents also rose 4.2% annually, following a 3.8% rise in the 12 months. This steady rise in property in Australia confirms that demand remains strong across the country, which offers good gains to sellers.

For investors, this is the right time to invest in Melbourne and other big cities. In the future, you can sell it at higher prices easily or generate a good rental income from it.

What’s Driving the House Price Rise in Australia?

Here are some of the key factors that are fuelling Australia’s property price growth:

Strong population growth

Population growth is at a historically high level in Australia, especially in cities Sydney, Melbourne, Brisbane, and Perth. Every year, people are moving to these cities for living, work, and career growth opportunities. This increases the demand for housing and rental units.

Limited housing supply

There is limited construction growth compared to property demands in Australia. The limited housing supply is due to rising material costs and labour shortage. This gap between supply and demand continues to push property prices upward.

Increasing investor activity

In 2025, more and more investors have started investing in land, property, houses, and units. The rise in rents and tight vacancies attracts investors to invest in properties in Melbourne or other big cities in Australia.

Government concessions and incentives

With the 5 per cent deposit rule for first-home buyers, tens of thousands of new buyers are expected to enter the property market in 2026. In addition, the Help To Buy Scheme will inspire eligible Australians to buy a property. Under this scheme, the federal government can contribute up to 30% for existing homes and 40% for new builds.

Which Cities Could See The Biggest Price Growth?

Inner cities, growing suburbs, and popular towns topped the list of house price surges in Australia. As per data, the two major cities are in high demand for property, with Sydney witnessing a rise of 0.5% in November and Melbourne values up by 0.3%. According to the Westpac economic team, Perth is estimated to deliver more gains by 2027.

Across the capital cities, property prices surge due to three cash rate cuts in 2025, which have boosted investors’ borrowing capacity. The retired Reserve Bank governor, Michele Bullock, said that the government measures to boost supply may not slow down property price growth until at least 2027.

How Property Price Gains Help Sellers

The current property market growth in Australia actually favours sellers. With rising buyer demand, limited housing options, and steady price growth, sellers can expect:

- Higher selling prices

- Shorter time on market

- Competitive offers

- Increased investor participation

According to property experts, if the supply remains tight in the coming years, house prices could even rise further. Growing suburbs in Melbourne, Victoria, Sydney, and other cities benefit from scarcity, strong local wage growth, advanced infrastructure, and lifestyle appeal.

So, investors who focus on scarcity and land value, gentrifying areas can consider investing in Melbourne or other areas for higher returns.

Closing Words

Australia’s housing market has continued to show remarkable growth and stability over the last few years. With another month of rising prices, there is strong confidence among buyers and investors. As experts forecast further price gains, sellers are well-positioned to benefit from it in the coming years. So, this is the right time to invest in property in Melbourne, Sydney, or any other city in Australia. In the coming months, you may get higher returns via selling the property or by renting it.

Need help? Call Property Buyers Australia. We can help you with every step of investing in land or houses in Melbourne and other cities.