Why Invest in Melbourne?

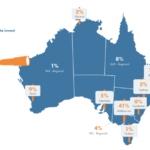

Recent data reveals that Melbourne is now attracting buyers—with nearly 41% of investors viewing it as the best place to invest for strategic, long-term growth. Population growth, relative affordability, economic stability, growing rental demand, and continually developing infrastructure are key factors restoring the city’s appeal.

Credit: PIPA

Following a prolonged post-COVID downturn in 2022, Melbourne is finally rebounding and attracting Owner-occupiers and investors once again. In fact, the capital city is tipped to lead the 2026 property boom in Australia.

According to the PIPA Annual Investor Sentiment Survey 2025, good long-term capital growth prospects are the top reason supporting investor optimism (70.3%), followed by strong population growth (58.5%) and being a major capital city (52.1%).

Likewise, there is an extensive list of credible data proving that Melbourne is bringing property buyers back in force. Let’s take a look at key stats, and then we’ll give you some irresistible reasons to invest in Melbourne at the earliest.

KPMG’s newest Residential Property Outlook recognizes Melbourne as the star performer in 2026.

Table 1: Forecast annual dwelling prices growth rate by property type and market (% y/y)

Credit: KPMG

KPMG Australia expects house prices in Melbourne to climb 6.6%, adding nearly $64,900 to the current median of $983,000—that’s nearly $178 a day. Units are also expected to jump 7.1% increasing in value by over $43,000, and outpacing all capitals except Darwin. (Source)

Rental prices in Melbourne are set to surge.

According to a new CBRE report, apartment rents in Australia’s capital cities, including Melbourne, could increase by around 24% between 2025-2030. Over the next five years, over 9,000 new apartments will be built in Melbourne every year, thanks to the growing demand for rental properties

But demand for homes may remain robust at some 38,000 units per year, leaving fewer properties empty and vacancy rates low, down from today’s level of 2.1% to a projected 1.4%.

This strong demand and limited supply make Melbourne’s property market a promising investment opportunity.

Interstate investors are leading the way.

Interstate investors in Melbourne account for 57% of total investor enquiries, nearly three times their 17% share in 2022. Many of these investors seek exposure beyond their home markets, and Melbourne appears to be an ideal market with strong long-term potential.

REA Group senior economist Anne Flaherty says,

“We have seen home prices start to increase again in 2025, and I think in addition to the population growth, we’re seeing the fact that interest rates are now coming down is giving people more confidence, particularly a lot of people like first home buyers, who may have been nervous to enter the market.”

Now, coming to the notion of “why invest in Melbourne” ↓

Why Invest in Melbourne Now (Key Driving Factors)

While there may be many reasons, the following are the key drivers fueling investors’ interest in the Melbourne property market:

Population growth

Melbourne is experiencing a significant population growth, estimated to reach 6 million by 2030. With the return of interstate and overseas migrants, the city will need millions of new homes. This will increase property rates in Melbourne in the coming year, making now the right time to invest.

Capital growth potential

Melbourne’s booming population, skyrocketing rental demand, and tight supply set the trifecta for capital growth. That’s one of the top reasons investors see Melbourne as a promising destination.

High rental demand

The KPMG report also highlights a slow but steady growth in rental demand; It’s at least above the long-term average. So, Investors targeting rental properties will see steady returns, especially in urban units. CBRE projects Melbourne apartment rents will surge 24% by 2030, driven by undersupply and strong demand.

Lower interest rates

The Reserve Bank of Australia (RBA) has already introduced three interest rate cuts by August, providing property buyers with some relief. Better borrowing capabilities give buyers confidence and help stabilize the housing market.

Continuous infrastructure development

Melbourne is focusing on its infrastructure to support the growing economy and to make the transportation system the best in the country. Some of the exciting projects include Metro Tunnel, North East Link, M80 Ring Road Upgrade, Melbourne Airport Rail Link, and more.

In addition, many commercial and residential projects are under construction that will boost the local economy, generate new jobs, and invite more people to a happy living. With all this, the property value will skyrocket in a few years.

Government incentives

There is good news for first-time property buyers in Melbourne. You may be eligible for government incentives, such as stamp duty concessions or grants. It makes investing in Melbourne more affordable for a better future.

Low home prices relative to other capital cities

Credit: realestate

Melbourne’s median property prices have grown more slowly than those in other major Australian cities, including Perth, Adelaide, and Brisbane. As a result, homes in Melbourne are now relatively cheaper than in many other capitals. This makes Melbourne look relatively undervalued and potentially attractive for investors for future capital growth.

What’s Next for Melbourne?

Undoubtedly, Melbourne’s property market is slow; but at the same time, it’s progressing steadily. Examining the statistics and growth patterns, it is evident that the market is experiencing positive growth.

Buyer demand is being bolstered by a healthier economic environment, where rising consumer sentiment, interest rate cuts, stretched affordability, and wage growth outpacing inflation are also key factors.

Looking to invest in Melbourne?

Although Melbourne’s property market is returning to the track, not all suburbs are worth investment. Additionally, since the market is still in recovery mode (although with significant growth potential), it’s best to work with licensed property advisors who are deeply familiar with the market.

If you agree with us, you can contact Property Buyers Australia Group, connecting buyers and licensed independent property professionals in one place.

It’s the right time to invest in Melbourne. So, do your due diligence and seek independent advice—and make an informed decision.